In 2004 There was hardly any discussion of an impeding financial disaster. At the time, Europe wanted the Bush administration to reduce its trade and budget deficits so that the dollar could be strengthen while the value of the Euro declines. Nearly ten years later, the European economy faces a multitude of economic issues that have led to riots in Greece and elsewhere.

The Genesis

Originally the EU was more or less an experiment in international relations. The underlying theme was that the integration of a series of nations economically, politically and socially will decrease the probability that these nations would go to war with each other.More specifically, The new Europe created custom blocks that would open trade within the continent yet agree on trade barriers abroad. This new Europe would allow for the freedom of movement for: goods, people, services and capital. Entrance into the Euro-zone was not cheap.

To enter this prestigious club nations had to maintain low inflation, interest rates, and government debt in order to join. New nations could not increase spending to a certain point nor print money to cover unemployment benefits to attract investors.

Like most ideas, It is good in theory but theory is often far removed from reality.

The German Hegemony

Germany's role in the European economy is as strong as Japan in Asia. The former Weimar Republic, sphere of influence in Europe is strong.

"You get an enormous sense of German Self-Righteousness, which is very difficult to take," said Francois Heisber of the International Institute for Strategic Studies. Jean-Pierre Jouyet a former french Minister for Europe said German's influence in Europe is strong, while his own country's role in shaping Europe's future is declining. Almost half the EU's exports to China are from Germany.

"The reform of the euro will create a more German Europe, but not quite the economic Pax Germanica"

Fortunately, for Greece, Merkel decided not use a "Debt Tzar" that would have power over the Greek's GDP is the worst in Europe. Its debt to GDP ratio is 143 percent.

Greek Economy

Greece, a country that entered the EU in 1981 followed by Spain and Portugal in 1986,currently has the highest debt. Part of the problem, particularly in Greece is that wages have outpaced the rate of productivity causing the current account deficit to reach ten percent of GDP. Greece could lower wages which would lower the cost of production making prices more competitive, however with a high unemployment rate such a solution is unlikely.

Although German exercises much influence over the direction of the European Union it is currently facing what appears to be an economic standoff with Greece over its debt.

Germany's leader Angela Merkel has demanded tighter control on the Greek economy including control over Greece's tax system. Merkel is doing this because the German public is reluctant to bailout the Mediterranean country a second time. Nevertheless, the erosion of Greece's economic sovereignty has left many Greeks upset.

Notwithstanding, Greek resistance to German's proposed austerity measures, Greece's labor minister George Koutroumanis came out in support of a three year wage freeze in addition to other programs for the past two years.

Can I borrow a Dollar?

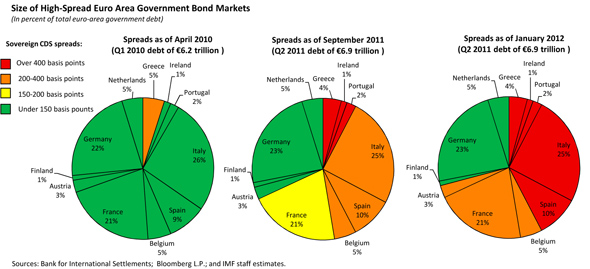

Greece is not the only country suffering from higher debt-GDP ratios as well. (Italy 119 percent and the leaders of the European Union (Germany and France) is at 80 percent, 20 percent higher than permitted by the Maastrict Treaty.

Of course it would be overly simplistic to place the blame on the economic crisis solely on the country known for its contributions to ancient philosophy. The value of Portugal bonds in foreign currency, has continuously fallen causing the yield on its ten year bond to reach 17.2 percent resulting in a 71 percent chance of defaulting within the next five years.

Portugal's neighbor is not immune to the economic crisis. Spain's economic performance is lackluster with barely .3 percent of GDP growth over the year. Perhaps more significant is Spain's embarrassingly high unemployment rate for young people which is more than twice the national average 22.8 percent.

Greece is often in the news for its provocative methods of protest but it is not the only country rebelling against austerity measures. Belgium has experienced its own version of opposition to austerity when unions called for a strike that compelled the country's rail network to close and left many trains and buses without drivers. International flights have been effected as well. Philippe Dubois, a railway union member outside Brussels' Midi station, told Reuters that:

"We are angry because they want to attack our pensions."

Even more prosperous countries like France were reluctant to undergo reform. In France, workers were angered over pension reforms which have created a blockaded for fuel refineries, causing 4,000 petrol stations to run dry.

the monetary calculus-currency

The economic relations between poorer and richer nations is not the only economic issue Europe has to confront. Just as in 2004, the role of the Euro in a world dominated by the dollar will be essential to resolving Europe economic problems.

Although The United States accounts for only 24 percent of global GDP its currency dominates various economic activities such as commodity pricing and foreign-exchange reserves. however, together the Euro and and the dollar make up 80 percent of the foreign exchange reserves.

There are some signs that shift is taking place. One study found that many central bankers wanted to diversify their foreign exchange reserves and in fact there has been a 2 percent increase in non-Euro/dollar in reserves from 11 percent to 13 percent.

One of the main concepts to explain the monetary system is the Mundell Trilemma. According to this concept a nation has three levers to manipulate the monetary system. States could stabilize their currencies, allow for greater capital mobility, and controlling their domestic monetary systems. However, only two options can be applied at a time.

For example, the United States choose to allow for greater capital mobility and political autonomy over the monetary system instead of a stabilized currency. In contrary, Argentina had fixed their currency to the dollar but did not have the same political independence afforded to it as the United States. If a country decides on a fix-exchange rate while promoting capital mobility it could lead to asset bubbles and inflation.

The problem in Europe is that every country in the Euro-zone is effected differently from monetary policy. For example, while one country may benefit from higher interest rates (control on wage increase) another country could find it difficult to respond to high unemployment because it would need lower interest rates to stimulate the economy. However, it was the lower interest rates that caused the real estate bubble in Spain five years ago.

One solution proposed by Sarkosy and Merkel was to increase the capital ratios of commercial banks to one trillion dollars in order to help countries such as Spain and Italy. However the banks decide to pursue this option because it might harm the interest of their share holders so it decide to limit loaning as a means to increase capital. Inevitably this caused the European economy to come to a halt.

BONDED TOGETHER

One answer to this monetary quagmire is for the Central Bank to buy bonds, however it could have inflationary consequences and some countries might feel that this would give countries with a weak economy a "license for Profligacy."

The European Central Bank was reluctant to purchase bonds because the ECB does not think that printing money is the best way to address the debt. Instead, European nations have set up a slush fund under the Fiancial Stability Facility to control the problem. The main obstacle is the agency did not have enough funds to cover countries like Spain and Italy if they become insolvent.

Still, many countries have issued bonds to help pay off their debt. Italy hit its head on the ceiling when it sold 6 billion dollars worth of five and ten-year bonds as interest rates fell significantly. In Portugal the interest rates on bonds for 10 years reached 15.8 percent and 5-year reached 20.8 percent.

In response to a potential default in Greece interest rates have risen, however some owners of sovereign debt agreed to accept a 50 percent reduction in the value of their bonds.

The situation becomes more complicate in Ireland and Spain were mortgage defaults have led banks to rely on government bonds that were decline in value.

The rule of Law

Legislation has been introduced to ensure that countries are more economically responsible by establishing the European Stability Mechanism, Europe to bailout countries. The new treaty grants the European Court of Justice the authority to enforce fines, and requires all Euro-zone countries create constitutional amendment which prevent governments from going into debt. Specifically, article 260 Lisbon Treaty discusses putative measures for handing countries with spiraling debt.

Is This the End

Some scholars have concluded that the issue is a struggle between richer and poorer nations with Europe. According to political economist Barry Eichengreen from the University of California, Berkeley, the struggle is between Southern Europeans who have suffered from severe cuts making it harder to pay its debt against Northern Europeans who perceive the Southern economy plagued with "corruption" and "Laziness."

However the conflict is more nuanced. Recently, French President Sarkozy said that Britian had "No industry left" when a reporter questioned him for suggesting that Britian should increase VAT. Sarkozy was quickly criticized by the press and one British government source claimed that the figures were more likely 11 percent in proportion to GDP.

Recently, Europeans decided to reach a consensus and put together an economic package close to a trillion dollars to fix the economic crisis. However the concerns of Germany are legitimate as articulated by the British magazine the Economist:

To Germans, this looked like the start of the dreaded “transfer union”, a bottomless commitment to subsidies Greeks’ early retirement, fix an Italian budget tattered by tax evasion and clear up after Spain ’s burst property bubble. “Sell your islands, you bankrupt Greeks. And the Acropolis while you’re at it,” demanded Bild, a popular tabloid. Mrs Merkel played to the gallery by suggesting that persistent euro sinners should be thrown out of the group.

While Merkel's uses tough rhetoric to appease the German's populism the truth is that the more countries that opt out of the European Union could have disastrous consequences for Germany. This is because Germany's exports have benefited from a fixed-economy as a result of a unified monetary system.

One option could be to let countries heavily burden in debt to default on its financial obligations. Lenders would lose money and the country would have to pay higher interest rates in the future but it would force Greece to be more frugal in the future.

Despite the negative press surrounding Europe's economic woes there are signs that the continent's economy is improving. Exports are booming and unemployment is expected to fall to levels last seen in the early 1990s.

Nevertheless if European countries want to stablize the regional economy there needs to be serious reforms including liberalizing labor markets, reducing beaucracy, preventing tax evasion, raising the retirement age and privatizing industries. It may be painful but these steps would be necessary for the long-term stability of the region.

No comments :

Post a Comment